Dallas, February 10, 2026

As the 2026 tax filing season approaches, Dallas residents are informed about key deadlines, available resources for free tax preparation, standard deduction amounts, and the Earned Income Tax Credit updates. The tax filing deadline for individual income tax returns is April 15, with options for extensions. Residents are encouraged to utilize IRS tools for tracking refunds and seek assistance from local tax centers for a smoother filing process.

Dallas Residents: Key Information for the 2026 Tax Filing Season

Dallas, Texas – As the 2026 tax season approaches, Dallas residents should be aware of important deadlines, potential delays, and available resources to ensure a smooth filing process.

Key Features of the 2026 Tax Filing Season

| Feature | Details |

|---|---|

| Tax Filing Deadline | April 15, 2026; Extensions available until October 15, 2026 |

| Free Tax Preparation Services | Community Tax Centers and VITA Program available in Dallas |

| Standard Deduction Amounts | Single: $15,750; Head of Household: $23,625; Married Filing Jointly: $31,500 |

| Earned Income Tax Credit (EITC) | Maximum credit ranges from $664 to $8,231, depending on number of children |

| Refund Tracking | Use IRS “Where’s My Refund?” tool, IRS2Go app, or IRS online account |

Tax Filing Deadlines

The deadline to file individual income tax returns for the 2025 tax year is April 15, 2026. Taxpayers unable to meet this deadline can request an extension using Form 4868, which grants an additional six months, making the new deadline October 15, 2026. However, it’s crucial to note that an extension to file is not an extension to pay; any taxes owed are still due by April 15 to avoid penalties and interest.

Potential Delays in Refund Processing

Taxpayers should anticipate potential delays in refund processing this year. The Internal Revenue Service (IRS) is operating with a reduced workforce, having lost approximately 19,000 employees due to federal workforce reductions, with only 2,200 new hires approved to offset this loss. This staffing shortage may lead to slower processing times for refunds and customer service inquiries.

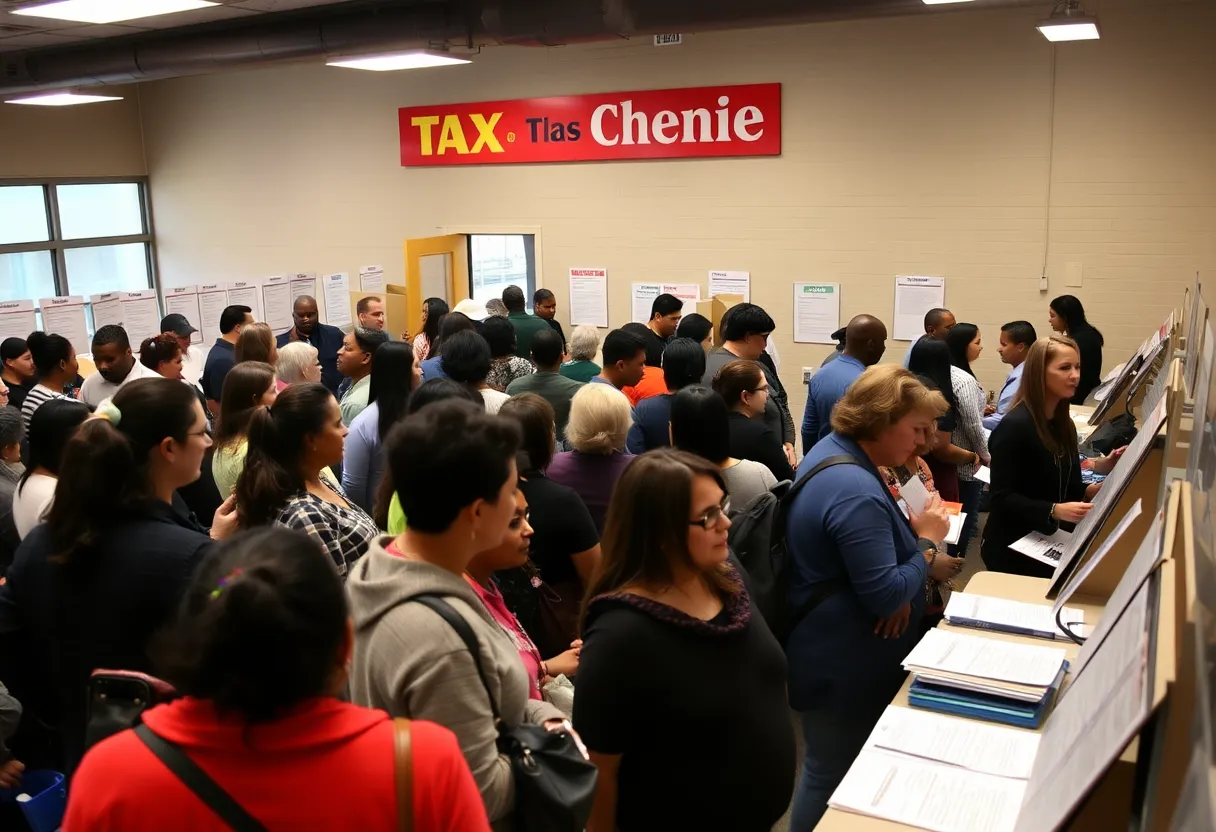

Free Tax Filing Assistance in Dallas

For those seeking assistance with tax preparation, several free services are available in Dallas:

- Community Tax Centers: Operated by Foundation Communities, these centers offer free tax preparation services to individuals earning under $69,000 per year and to households of 2–4 people earning under $85,000 per year. The income limit increases by $5,000 for each additional household member. Locations are open starting Saturday, January 24, 2026, with no appointment required.

- Volunteer Income Tax Assistance (VITA) Program: This program provides free tax help to people who generally make $60,000 or less, persons with disabilities, and limited English-speaking taxpayers. VITA sites are available at various community centers and nonprofit organizations throughout Dallas.

Standard Deduction Increases for 2026

For the 2026 tax year, the standard deduction amounts have increased, which may benefit many taxpayers:

- Single filers: $15,750

- Head of Household: $23,625

- Married Filing Jointly: $31,500

Taxpayers aged 65 and older may qualify for additional deductions. For instance, single seniors with an adjusted income below $75,000 can receive an extra $6,000, while married seniors with a combined adjusted income below $150,000 can receive an additional $12,000.

Earned Income Tax Credit (EITC) Updates

The EITC, a refundable federal tax benefit aimed at supporting low- to moderate-income workers, has seen slight increases due to inflation adjustments. In 2026, the maximum credit ranges from $664 (for filers with no children) to $8,231 (for those with three or more children). To qualify, taxpayers must meet specific income limits and other criteria.

Tracking Your Refund

To monitor the status of your federal tax refund, you can use the IRS “Where’s My Refund?” tool, the IRS2Go mobile app, or your IRS online account. Refunds are typically issued within 21 days of IRS acceptance, but delays may occur due to various factors, including errors or additional verification requirements.

Additional Resources

For more detailed information and updates, visit the IRS website or consult with a tax professional to ensure compliance with all tax obligations and to take advantage of available credits and deductions.

Deeper Dive: News & Info About This Topic

HERE Resources

Arlington Transforms into a Regional Transit Hub

DART Holds Community Meetings on Proposed Service Changes

Key Tax Deadlines and Relief for Dallas Residents

Illuno Unveils Innovative Business Security Platform in Dallas

Dallas Faces Changes in Tax Filing Options

Gregory Law Group Expands Tax Services for Dallas Businesses

Intuit Launches TurboTax Flagship Store in New York City

Deadline Approaches for Tax-Exempt Organizations’ Form 990 Filings

University Park Considers DART Withdrawal Amid Concerns

Concerns Rise Over Jasmine Crockett’s Electability in Texas Senate Race

Author: STAFF HERE DALLAS WRITER

The DALLAS STAFF WRITER represents the experienced team at HEREDallas.com, your go-to source for actionable local news and information in Dallas, Dallas County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as the State Fair of Texas, Deep Ellum Arts Festival, and Dallas International Film Festival. Our coverage extends to key organizations like the Dallas Regional Chamber and United Way of Metropolitan Dallas, plus leading businesses in telecommunications, aviation, and semiconductors that power the local economy such as AT&T, Southwest Airlines, and Texas Instruments. As part of the broader HERE network, including HEREAustinTX.com, HERECollegeStation.com, HEREHouston.com, and HERESanAntonio.com, we provide comprehensive, credible insights into Texas's dynamic landscape.